Budget and Financial Information

Our Board dedicates a substantial amount of time and energy to adopt a yearly operating budget before the beginning of each fiscal year. The budget serves as a policy document, an operations guide, a financial plan, and a communication device. The board also adopts an annual capital budget. The process for developing our budgets typically begins with Board strategic planning in June or July and, through a series of meetings and analysis, results in an operating budget and a prioritized capital budget before the beginning of the fiscal year. Your CCRTA may not spend more than the approved operating budget and must approve increases to the budget. The CEO may permit the movement of funds within the approved budget. If these reallocations are significant, Board approval is obtained. Here you will find a Budget Summary and links to budgets for the last five years and ways to contact Board Members and appropriate management for questions.

Financial Summary

Data presented is from the most recently completed, audited fiscal year. The Agency’s fiscal year is from January 1 to December 31st

Revenues

Expenditures

FTE Positions

Budget Last 5 Years

Proposed Budgets - Past 5 Years

Annual Comprehensive Financial Report (ACFR)

RTA Employees Defined Benefit Plan and Trust Financial Reports

Investment Policy

Expenses

FTE Positions

Management Pay

- CEO

- $237,993.60

- Deputy CEO/Chief Safety Officer

- $203,216.00

- Managing Director of Administration

- $176,696.00

- Managing Director of Operations

- $176,696.00

- Managing Director of Customer Service & Capital Projects

- $176,696.00

- Managing Director of Public Relations

- $170,705.60

- Director of Transportation

- $152,048.00

- Director of Human Resources

- $147,097.60

- Director of Finance

- $141,377.60

- Director of Procurement

- $141,190.40

- Director of Vehicle Maintenance

- $136,843.20

- Director of IT

- $131,539.20

- Director of Planning

- $122,387.20

Introducing…The CCRTA

A group of amazing people like our Board of Directors deserves an introduction.

An eleven-member Board of Directors governs the Corpus Christi Regional Transportation Authority (CCRTA), which was created in 1985 by the public’s vote to provide quality accessible and affordable transportation to the residents of Nueces and San Patricio Counties. The CCRTA Service Area covers 838 square miles. The CCRTA, also known as the ‘B,’ provides fixed-route service, tourist, commuter, public event, and van/carpool services. Additionally, the CCRTA offers Paratransit Bus Service called B-Line, which provides shared-ride public transportation for people whose disabilities prevent them from using fixed-route bus services.

Meet Our Board of DirectorsSTAFF

Audits and Reviews

The Corpus Christi Regional Transit Authority is critical to keeping this area moving—both in a literal sense and in support of affordability, accessibility, equity and protecting our environment. The Mission that we established so many years ago, hasn’t changed. We were created by the people to provide quality transportation and enhance the regional economy in a responsible manner consistent with its financial resources and the diverse needs of the people. We know we have an incredible responsibility in helping plan for our city’s future. Each year we strive to improve our reliability as well as develop procedures, training and technologies to reduce any type of accidents. We are dedicated to planning and building a transportation network that provides excellent choices and safely connects people to the places they need to go, now and in the future. Attached you’ll find the annual reports for the last five years that chronicle our efforts and successes.

Annual Comprehensive Financial Report

Triennial Review

Quadrennial Review

RTA Employee Defined Benefit Plan & Trust

Transaction Records

The Corpus Christi Regional Transportation Authority operates year in and year out almost constantly. The resources we employ to get our riders from destination to destination safely, and on time in the most cost-efficient ways is nothing short of daunting. We bid vendors and audit their invoices then have them justify costs whenever anything is in question. It is our duty to employ such scrutiny so that we keep the costs low for our riders. With such attention to the bottom line we have no problem opening our books to the public. In this section you will have access to financial reports, AP records and check registries for the last three years. We welcome your inspection and any questions you have based on what you find. We strive for complete transparency and honesty in all our dealings. Being accountable to the people of this area is a responsibility we don’t take lightly. We know we must earn your trust every day.

HB 3693 Compliance

Accounts Payable Check Registers

Claims Check Registers

Annual Claims Check Registers

Vendor Annual Check Register

Open Contracts

Supplies

- Vehicles

- Fuel

- Furniture

- Computer Equipment

- Lubricants

Construction

- Paving & Concrete Work

- Bus Shelter Construction

- General Construction

Services

- Uniforms

- Shelter Maintenance

- Printing

- Landscaping

- Waste Disposal

- A / C & Heating Repair

Professional Services

- Training

- Architectural Engineering

- General Consulting

- Accounting & Auditing

Pension Information

The employees at the Corpus Christi Regional Transit Authority are a close knit group that come to work each day living up to our high standards. The tenure of our employees obviously runs the gambit from newly hired to employees that have been with us for decades. We do whatever we can to hold onto these incredible employees, they are our best assets. Rewarding them for their passion and dedication is something we take pride in. In establishing a Pension program, we did so with the desire of financially compensating our tenured employees to the level that they so rightly deserve. Enclosed you will find our investment methodology and policies, we have also included a Summary of EDBP Eligibility and Pension Management Statements. In this way CCRTA shows the public as well as those in our organization how we value our employees for years to come.

Pension Overview

Annual Trust Statements

Actuarial Reports

Capital Project Financing Strategies

CCRTA utilizes a variety of methods for financing transit improvements that include fleet replacement, garage facilities, and bus stop improvement and amenities. These projects may be funded 100% by CCRTA or partially funded through a cost sharing arrangement. Cost sharing arrangements may include government grant awards or from joint development strategies. Grants typically require the Authority to provide a local match ranging from 15-20%. Joint development is a strategic partnership between the public and private sectors to maximize the utility and value of the transit system. CCRTA utilizes current revenues for project costs that are expected to be completed within the current budget year. Internal reserves for funding large, multi-year projects have been established by Board approved reserve policies to address the capital needs of the Authority.

Long-term debt is only used to source financing for authorized multi-year infrastructure related projects as in the case of the revenue bonds that were issued to fund the new Customer Service Center and transfer station projects.

Debt Obligation Overview

CCRTA’s debt obligations stem from the October 8, 2019 issuance of $20,265,000 in refunding revenue bonds. This includes $15,055,000 in serial bonds and $5,210,000 in term bonds, with the latter maturing on December 1, 2028. The bonds are issued in $5,000 units with staggered maturities.

Refinancing the original 2013 debt resulted in $3,778,208 in interest savings and removed a restrictive covenant, releasing $1.6 million in cash reserves. The refinancing lowered the interest rate from 5.53% to 3.01%, achieving a 6.31% PV Savings Ratio—exceeding the Board’s 3.00% minimum threshold. The 2019 bond covenants also allowed CCRTA to purchase a $28,183 reserve fund insurance policy, further releasing $1.6 million for principal reduction.

These bonds are special obligations secured by CCRTA’s farebox (system) revenues. The bond covenant requires CCRTA to maintain fare and service rates that generate gross operating revenues sufficient to cover operating expenses while maintaining net operating revenues at least 1.10 times annual debt service requirements.

S&P Global Ratings assigned an “A+” long-term rating to the 2019 refunding bonds and affirmed the same rating for CCRTA’s outstanding system revenue bonds and issuer credit.

As of January 1, 2025, the outstanding balance on the Series 2019 Taxable Refunding Bonds is $15,855,000, with a final maturity on December 1, 2038. The bonds become callable on December 1, 2028.

The original 2013 issuance totaled $22,025,000 and was CCRTA’s first debt issuance. The bond proceeds funded the construction of the Staples Street transfer station and the adjacent 70,429-square-foot Staples Street Center, which houses customer service, administrative offices, and leased tenant space generating approximately $500,000 in annual rental income.

Maturity & Interest Rates Information

Click here to view file as a .pdf

Click here to view file as a .pdf

Debt Balance

Total Outstanding Debt Obligation

Click here to view a .pdf

Click here to view a .pdf

Amortization Schedule

Visualizations

Debt Obligations. Financing Structure and Purpose

Refunding Bonds

The refunding bonds consist of $15,055,000 in serial bonds, with staggered maturity date, and $5,210,000 in term bonds. The first optional call date for these bonds is December 1, 2028.

Series 2019 System Revenue Refunding Bonds – $22,265,000

- Refinancing of Series 2013 bonds.

Series 2013 (AMT) Tax-Exempt Revenue Bonds – $11,525,000

- Renovation of the existing Staples Street bus transfer station.

- Construct and equip a portion of a new multi-use building adjacent to the Staples Street bus transfer station, and.

- Construct a new parking lot to serve the Staples Street bus transfer station and the multi-use building, and;

- Pay the costs of issuing the Tax-Exempt Bonds.

Series 2013 Taxable Revenue Bonds – $10,500,000

- Construct and equip a portion of a new multi-use building adjacent to the Staples Street bus transfer station and.

- Pay the costs of issuing the Taxable Bonds.

The multi-uses of the facilities being constructed called for a financing structure that would include both taxable and tax-exempt revenue bonds.

Debt Payment

The 20-year bonds are first lien refunding bonds, and will be repaid, semi-annually from the pledged operating revenues of the Authority. Pledged revenues, as defined by the bond resolution, include the net operating revenues, plus any additional revenues, income, receipts, or other revenues which are pledged by the issuer. The interest rates adjust periodically during the life of the bonds.

Bond Rating

S&P Underlying Rating (SPURs) affirmed its ‘A+’ rating on the Corpus Christi Regional Transportation Authority (CCRTA), Texas ‘ series 2019 system refunding bonds. At the same time, S&P affirmed ‘A+’ issuer credit rating (ICR) on CCRTA.

Continuing Disclosures

CCRTA will provide certain updated financial information and operating data to EMMA (Electronic Municipal Market Access) annually. EMMA is a service of the Municipal Securities Rulemaking Board which is the official repository for information on virtually all municipal bonds providing free access to official disclosures and other data about the municipal securities market.

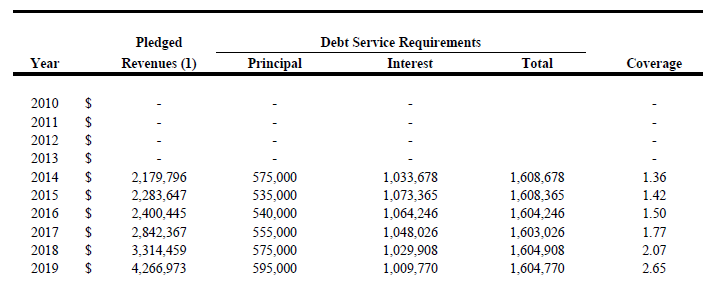

Revenue Recovery Ratio/Debt Capacity

The revenue recovery ratio measures the cash available from operating revenues to the current debt obligation of interest and principal payments. A ratio greater than 1 means there is sufficient funds to cover the annual debt payment. CCRTA began repaying the debt in 2014 and since then has maintained a revenue recovery ratio greater than 1.

Debt Information Files

Payroll

2015 - Aggregate Payroll Expenditures

2016 - Aggregate Payroll Expenditures

2017 - Aggregate Payroll Expenditures

2018 - Aggregate Payroll Expenditures

2019 - Aggregate Payroll Expenditures

2020 - Aggregate Payroll Expenditures

Payroll Reports

CONTRACTS & PROCUREMENT SUMMARY

PROCUREMENT TRANSPARENCY

Transparency in public procurement at CCRTA means that information on the public procurement process is available to everyone: contractors, suppliers, service providers and the public at large unless there are valid and legal reasons to keep certain information confidential.

When a public procurement requirement is published or made available to the market by any means (electronically, press, internet portal, etc.), the announcement will contain sufficient details for interested contractors, suppliers and service providers to compete for the job.

Please follow the instructions contained in the procurement request documents.

Procurement Policy

The Corpus Christi Regional Transit Authority (CCRTA) is committed to providing a level playing field with regard to contracting and employment opportunities. We have steadfastly developed strict guidelines when it comes to how we do business with vendors. CCRTA establishes goals, evaluates bids and specifications to identify potential barriers to participation by Small Business Enterprises (SBEs), Disadvantaged Business Enterprises (DBEs), and Local Business Enterprises (LBEs), and monitors contracts to ensure that contractors meet their commitments to utilizing listed firms. By putting these guidelines in place and monitoring them we believe that all parties receive fair treatment and consideration, while making it competitive enough allowing us to maintain fiscal responsibility.